Learn Smart. Trade Smarter

TRADING OPTION

WHY TRADE CURRENCIES?

Easy to understand

Largest Market

Highly liquid

Cheaper to trade

Available 24 hrs a day

Leverage

ABOUT US

About Learn & Trade FX Trade

Secure Transaction

Your safety is our priority. We ensure every transaction is protected with the highest standards of security

Global Services

Trade and learn without borders our platform is built to support users worldwide

ONE MARKET TO RULE THEM ALLONE MARKET TO RULE THEM ALL

Often overlooked by retail traders, the massive forex market has become very accessible to just about anyone. All you need to start trading currencies is a relatively modern Internet-connected device and a modest deposit to use as margin. Once you achieve consistent profitability trading forex, even while operating in a small trading account, your strategy can scale up to produce even more profits in a much larger trading account. Yet, this sounds easier in theory than it is in practice. The forex market requires patience, planning and discipline. You will have to resist the temptation of entering a trade for the sake of simply being in the market. While the forex market is typically slower-paced than some other asset classes, like stocks or commodities, currency trading is not without perils.

FEATURES

Our Platform Feature

Accepting All Currency

More Than 600+ Trading Instruments

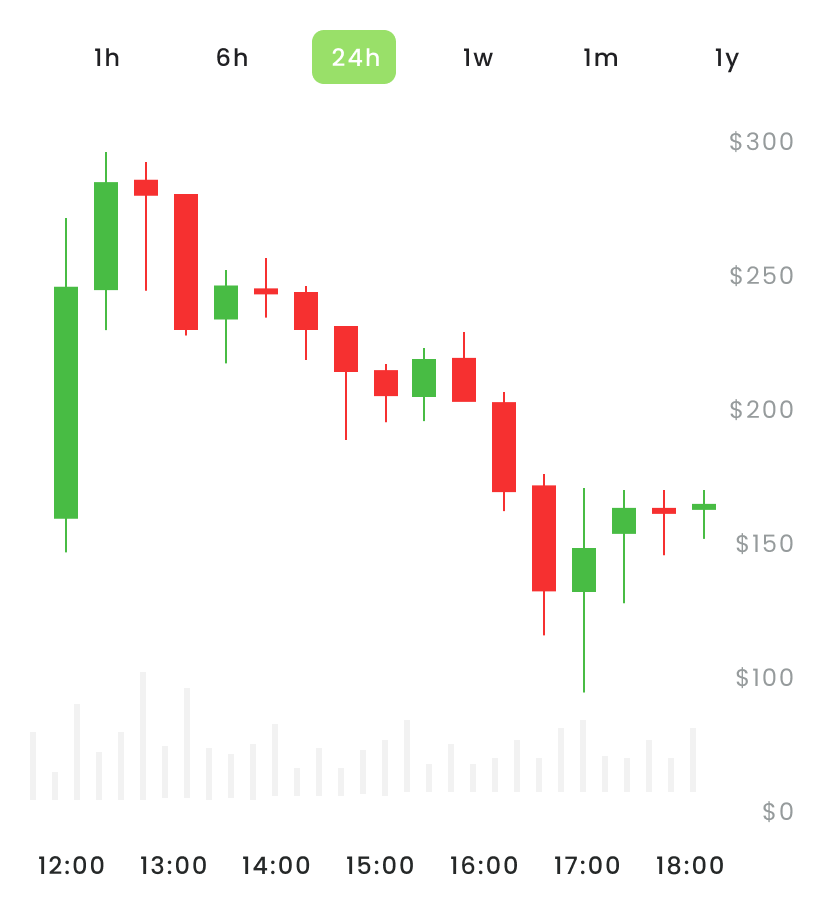

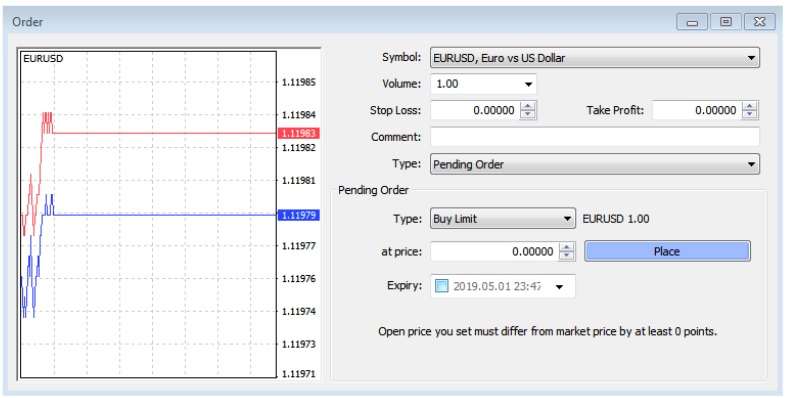

Ways to read the main types of Forex Charts

1. Tick Charts

If you are just learning forex trading, this list should give you a good overview of how to read primary forex charts. You will find that certain forex charts give you more useful information than others. One trader might achieve soaring success using a tick chart while another hates reading tick charts and makes good money using candlestick charts.

While you may get recommendations from your friends or

colleagues, you should try all these charts until you find one that you feel works best. You should not feel you are attached to one chart that

2. Point and Figure Charts

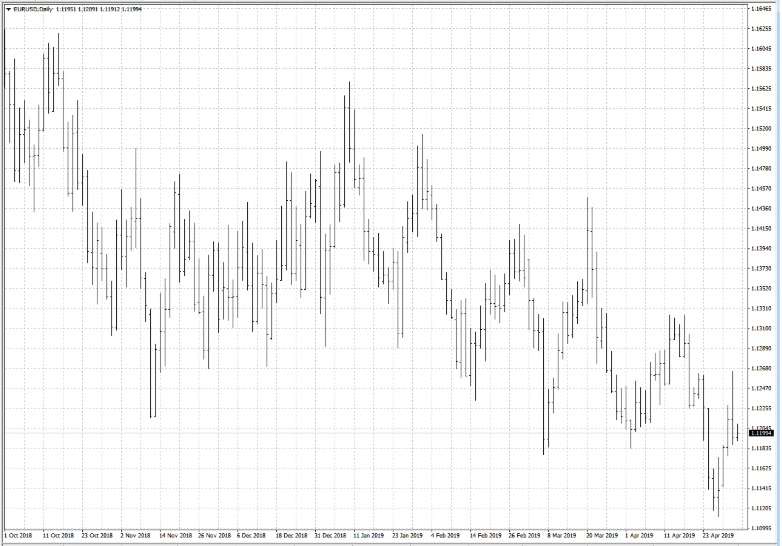

3. Line Charts

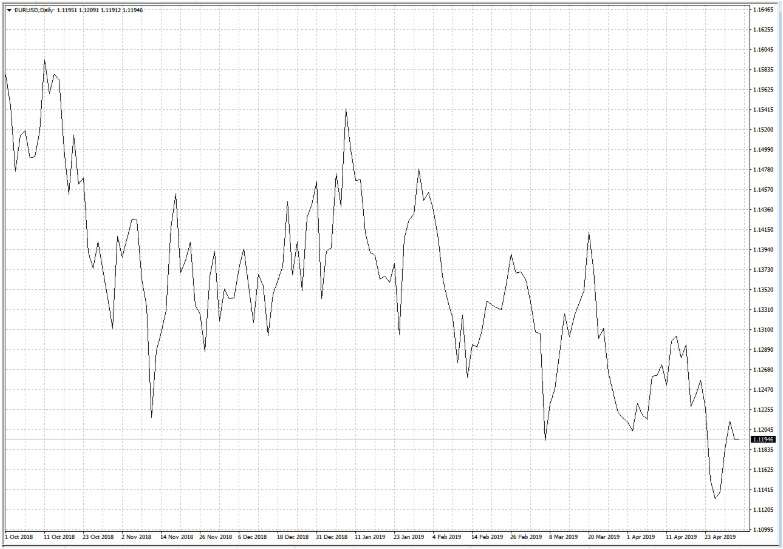

4. Bar Charts

5. Candlestick Charts